Compound interest is a powerful tool. Here’s how it can be put to work for you using the “Rule of 72.”

Compound interest can be intimidating at first glance. However, it can be simplified by focusing on two things: INTEREST RATE and TIME.

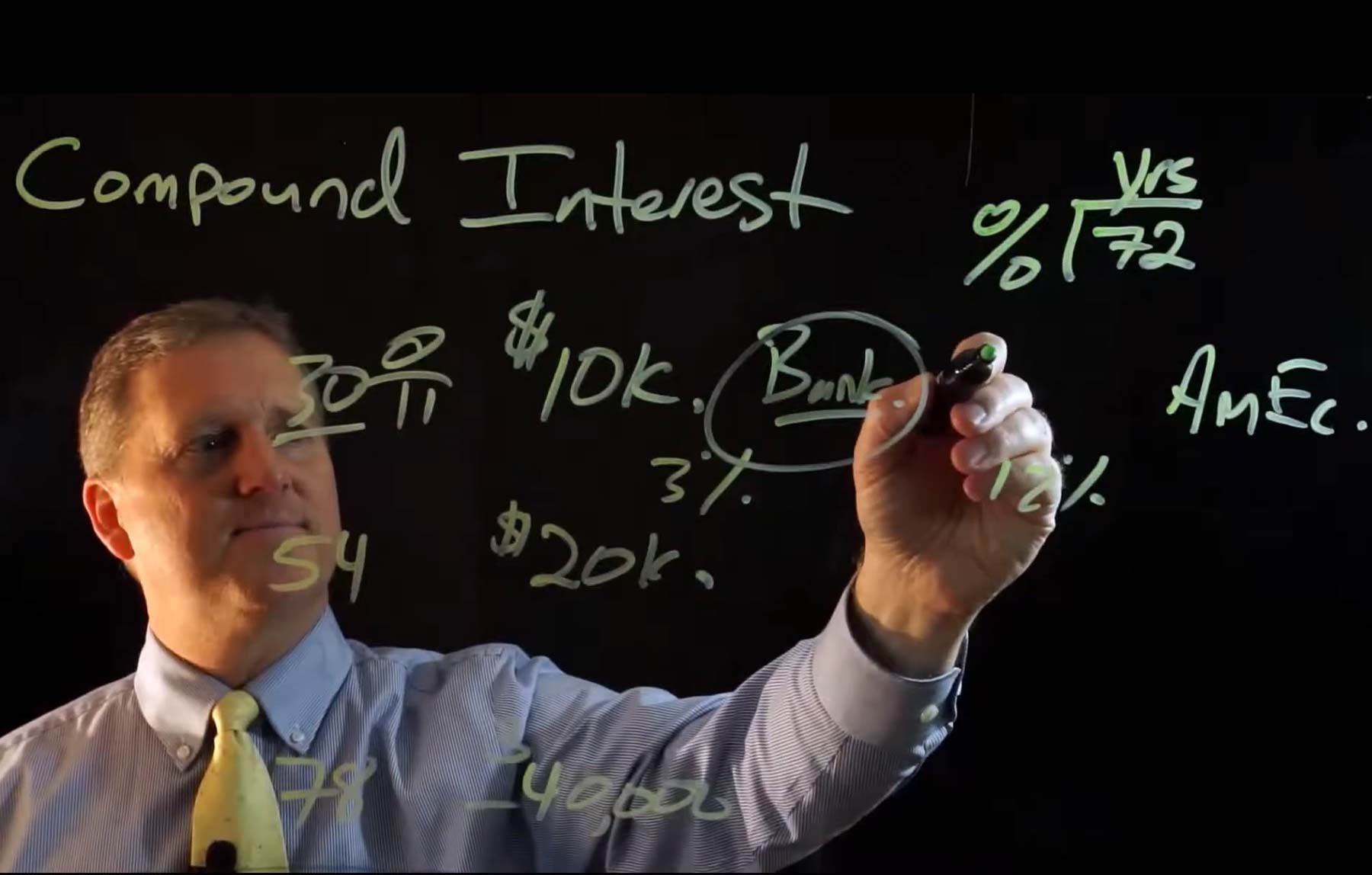

Using the “Rule of 72,” you can determine approximately how many years it will take your money to double based on your long-term average rate of return. Just divide your interest rate into 72 to find out how many years it would take to double your money.

For example, if your interest rate is 3%, just divide 3 into 72 to get 24 years to double your money. At 12% interest, just divide 12 into 72 to get six years to double your money. Feel free to play with the calculator below by adjusting either the interest rate or the number of years to double.

A final thought: There are thousands of investment alternatives. The rules for investing are complicated. Just as you do not fill your own cavities or perform your own physical exams, it makes sense to have a seasoned professional help with your “financial physical.”

We have the expertise to help you evaluate the level of risk in your portfolio and adjust your plan due to changing circumstances. What you’re paying for when you hire an advisor is not information—you can get that from anywhere. You’re paying for experience—the difference between information and wisdom.

”Money makes money, and the money that money makes, makes more money."

- Benjamin Franklin